Let's cut to the chase. As a marketing professional, I've seen countless eCommerce businesses get obsessed with vanity metrics. But the one number that truly matters is Customer Acquisition Cost (CAC). It’s the total price you pay to win over a new customer. It's not just your ad spend; it's the full cost of your marketing and sales efforts—from Google Ads campaigns to agency fees—divided by the number of new customers you brought in.

Why This One Metric Is So Important

As the founder of a digital marketing agency in Melbourne, I've had a front-row seat to what separates thriving eCommerce stores from the ones that burn through cash. That one number is the Customer Acquisition Cost, or CAC. For any online business, from a new Shopify store built by a Shopify developer to an established brand, understanding your CAC is absolutely non-negotiable.

Think of it as the ultimate health check for your business model. A low CAC means you're efficiently turning marketing dollars into paying customers, paving the way for profitable growth. A high CAC, on the other hand, is a massive red flag that you might be spending more to get a customer than they'll ever actually spend with you. That's a fast track to failure, and I've seen it happen.

What Goes into Your CAC

Calculating this number properly means looking beyond just your ad spend. It’s about getting a brutally honest picture of every cent you invest to attract new business. I always tell my clients to think bigger and include all the moving parts, because that's the only way to get a true figure you can base real decisions on. From my real-world experience, this is what you need to track.

Here are the core components you absolutely need to factor in:

- Ad Spend: This is the most obvious one. It’s every dollar spent on platforms like Google Ads, Meta (Facebook and Instagram) Ads, and any other paid channel. If you're running PPC for tradies or complex Google Shopping ads, this is your primary cost.

- Salaries: You have to account for the salaries of your marketing and sales teams. If a team member spends half their time on acquiring new customers, then half their salary should be included in your CAC calculation.

- Agency Fees: If you're working with a marketing agency in Melbourne like us for services such as a local SEO campaign, PPC, or Shopify development, those fees are a direct acquisition cost.

- Software and Tools: The cost of your marketing technology stack—email marketing platforms, analytics tools like Google Tag Manager, CRM software, and even call tracking software for PPC—all add up. Don't forget them.

- Content and Creative Costs: This covers any money spent creating ad visuals for your Meta ads creative testing process, writing blog posts, or producing videos.

To make this clearer, let's break down how these expenses might look for a typical online store.

Quick Breakdown of CAC Components

This table simplifies the key expenses that go into calculating your total Customer Acquisition Cost.

| Expense Category | What It Includes | Example for an eCommerce Store |

|---|---|---|

| Ad Spend | Payments to advertising platforms for clicks, impressions, or conversions. | Monthly budget for Google Shopping, Facebook retargeting ads, and TikTok campaigns. |

| Salaries | Wages for marketing and sales staff involved in customer acquisition. | Pro-rated salary of the marketing manager and the social media coordinator. |

| Agency/Freelancer Fees | Costs for external partners managing marketing or creative tasks. | Monthly retainer paid to an SEO agency in Melbourne or fees for a freelance copywriter. |

| Software & Tools | Subscriptions for marketing automation, analytics, and CRM platforms. | Monthly cost for Klaviyo (email), Ahrefs (SEO), and HubSpot (CRM). |

| Creative Costs | Expenses for producing ad creative, content, and design assets. | One-off cost for a product photoshoot or video ad production. |

Getting a handle on these components is the first step. Once you add them all up, you have your total investment.

The real power of knowing your CAC is that it forces you to look at your marketing not as an expense, but as an investment. It answers the most important question: for every dollar I put in, how many customers am I actually getting out?

Ultimately, this number reveals which of your marketing channels are burning cash and which ones are printing it. Knowing your CAC is the critical first step toward making smarter budget decisions and building a truly sustainable business, especially in the competitive Australian market where every dollar counts.

Alright, let's get our hands dirty and actually calculate this thing. The formula itself looks simple, but the real magic is in knowing exactly what numbers to plug in. I’ll walk you through the basic calculation before we apply it to a real-world scenario so you can see how it works.

The basic formula is pretty straightforward:

CAC = Total Marketing & Sales Costs ÷ Number of New Customers Acquired

You'll want to run this calculation over a specific period, like a month or a quarter. Doing this gives you a clean snapshot of your performance and stops things from getting messy.

The Basic Formula in Action

First things first, you need to add up every single dollar associated with bringing in new customers. Theory is one thing, but let's make it real. Imagine a fictional Shopify store based right here in Melbourne. We’ll call it "Melbourne Pet Supplies."

Over the last quarter, the owner spent money on a few key areas to attract new buyers. This is where you have to be brutally honest with yourself; you can't leave anything out if you want a true number.

A Real-World Shopify Example

Let's break down the quarterly costs for Melbourne Pet Supplies. We'll add up all the expenses that went into acquiring customers to get our total investment.

Quarterly Marketing & Sales Costs:

- Google Ads Spend: They put $3,000 into a Google Shopping campaign to catch people actively searching for pet products. We find that Google Ads for service-based businesses often has a different cost structure, but for eCommerce, this is a typical start.

- Facebook Ads Budget: Another $2,500 went into Meta Ads, mainly focusing on retargeting people who visited the site and building lookalike audiences. Their Facebook ads agency helped them set this up.

- SEO Agency Fees: They hired a local SEO agency in Melbourne on a $1,500 per month retainer, which comes to $4,500 for the quarter to improve their organic visibility.

- Email Marketing Software: Their subscription to Klaviyo is $150 a month, so $450 for the quarter.

- Marketing Staff Salary: They have one marketing coordinator who earns $60,000 a year. Let's say we attribute 50% of their time to new customer acquisition, which works out to $7,500 for the quarter.

Now, let's add it all up:

$3,000 (Google) + $2,500 (Meta) + $4,500 (SEO) + $450 (Software) + $7,500 (Salary) = $17,900 Total Costs

During that same quarter, Melbourne Pet Supplies brought in 200 new customers. With these numbers, we can finally plug them into our formula.

CAC Calculation:

$17,900 (Total Costs) ÷ 200 (New Customers) = $89.50 per customer

See? It’s not so intimidating once you break it down. This practical approach shows it’s accessible even if you're not a numbers person. Data reinforces just how critical these figures are for Australian businesses. For instance, in Q1 2025, the average Aussie eCommerce business acquired 240 new customers at a total CAC of $97.29 per customer, from over $23,000 in combined expenses. You can delve into the data about Australian CAC benchmarks to see how your own numbers stack up.

A Simple Spreadsheet to Get You Started

You don't need fancy software to get on top of this. I always tell my clients to start with a simple spreadsheet. It’s the easiest way to get into the habit of tracking your CAC regularly.

Here's a basic structure you can copy and use today:

| Cost Category | Monthly Cost |

|---|---|

| Google Ads Spend | $1,000 |

| Facebook Ads Spend | $833 |

| SEO Agency Fees | $1,500 |

| Software Subscriptions | $150 |

| Pro-rated Salaries | $2,500 |

| Total Monthly Cost | $5,983 |

| New Customers Acquired | 67 |

| Monthly CAC | $89.30 |

By tracking this monthly, you start to take real control of your marketing budget. It stops being a vague "expense" and becomes what it truly is: a measurable investment in your growth.

Understanding Australian eCommerce CAC Benchmarks

One of the first questions clients always ask me is, "Is my CAC any good?"

My answer is always the same: it depends. Your industry, your business model, and especially your location all play a huge role in what a "good" Customer Acquisition Cost actually looks like.

For Australian eCommerce businesses, this context is everything. We can't just pull global averages from a blog post and call it a day. Our market is unique, and understanding why is the key to setting realistic goals for your ad spend and figuring out if you're on the right track. This includes understanding the nuances between campaign types, like PMAX vs Google Shopping ads.

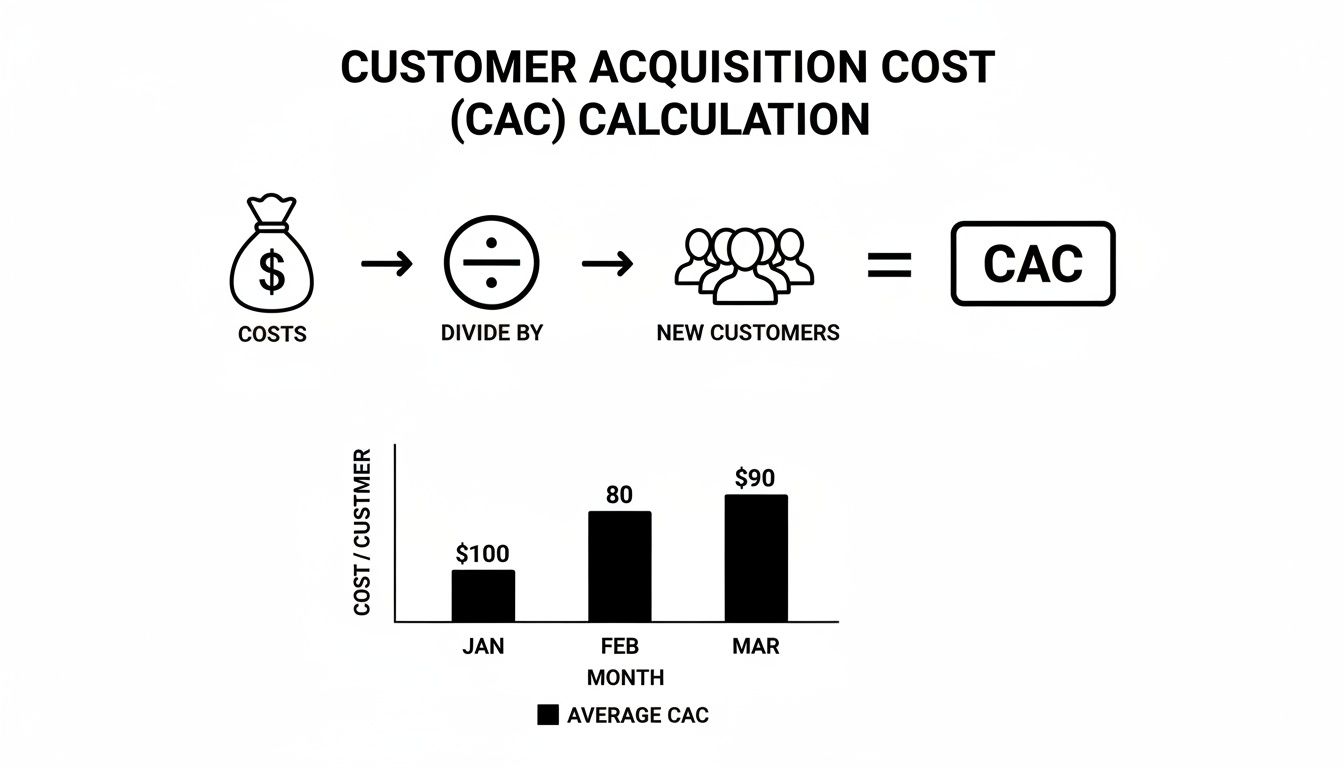

This simple diagram breaks down the core calculation, showing how your total costs and new customers come together to define your CAC.

This visual shows that understanding CAC starts with a clear view of your total investment versus the number of new customers it generated.

Why Australian CAC Is Different

From my experience running a digital marketing agency in Melbourne, I've seen firsthand that Australian businesses often face a higher CAC than their US or European counterparts. There are a couple of key reasons for this.

First, we have a smaller population spread over a huge area, which means ad auctions on platforms like Google and Meta can get pretty concentrated and competitive. Fewer users in the auction pool often drives up bidding costs to reach the right audience.

This reality means Aussie businesses frequently stare down a 20-35% higher CAC than US averages. Global benchmarks from platforms like Shopify might suggest a CAC of around $68-$78, but for us, that often looks more like a realistic $82-$105 per customer. As you can read in this detailed analysis on eCommerce CAC, this "Australia tax" is a critical factor for local businesses.

This isn't meant to be discouraging; it's about being realistic. Knowing this helps you set achievable goals and stops you from thinking your campaigns are failing when they’re actually performing well within our local market.

Average CAC by Industry in Australia

To give you a clearer picture, let's look at some typical CAC ranges I see when working with clients across different sectors here in Australia. These are not hard-and-fast rules, but they provide a solid starting point for comparison.

| Industry | Average CAC Range (AUD) | Key Influencing Factors |

|---|---|---|

| Beauty & Cosmetics | $50 – $75 | High competition, strong brand loyalty, high LTV potential. |

| Fashion & Apparel | $40 – $90 | Saturated market, fast fashion vs. high-end, seasonal trends. |

| Food & Beverage | $30 – $80 | Subscription models vs. one-off purchases, perishable goods. |

| Home Goods & Furniture | $60 – $120 | High average order value, longer sales cycle, high shipping costs. |

| Electronics | $70 – $100 | High-ticket items, intense competition from major retailers. |

These figures give you a ballpark to aim for. If your costs are way outside these ranges, it's a clear signal that it's time to dig deeper into your strategy and see what's going on.

Remember, these are just benchmarks. Your own CAC will be influenced by your brand's reputation, the effectiveness of your ad creative, and the quality of your website's user experience. A slick, fast-loading Shopify or WordPress website developed by professionals can significantly lower your CAC by improving conversion rates.

Understanding these benchmarks helps you evaluate your performance properly. It’s the first step to knowing whether your marketing spend is an investment or just a cost.

Pinpointing Your Most Profitable Marketing Channels

Knowing your blended, business-wide Customer Acquisition Cost is a great start, but it’s a bit like looking at your business from 30,000 feet. You can see the big picture, but you're missing the crucial details on the ground.

The real insights—the ones that let you scale profitably—come from calculating your CAC for each individual marketing channel. This is how we, as a marketing agency in Melbourne, find the hidden winners for our clients.

By isolating costs and attributing new customers to specific channels like Google Ads, Meta Ads, or organic SEO, we get a crystal-clear view of what’s actually working and what’s just burning cash. This granular approach is the only way to confidently decide where to double down on your budget and where you might need to pull back.

Calculating CAC for Paid Channels

Let's start with the most straightforward channels: your paid advertising. This is where the maths is direct, and the cause-and-effect relationship is easiest to see.

The formula is just a more focused version of our overall CAC calculation:

Channel-Specific CAC = Total Spend on that Channel ÷ New Customers from that Channel

For a Shopify store, tracking this is relatively simple. Platforms like Google Ads and Meta have built-in conversion tracking that, when set up correctly (often requiring expertise in GTM and Google Analytics), can tell you exactly which ads led to a sale.

Example: A Google Ads Campaign

Let's say one of our clients spent $2,000 on a Google Shopping campaign last month. By looking at their Google Ads dashboard and cross-referencing it with their Shopify analytics, we can see that campaign directly generated 40 new customers.

The calculation is simple:

$2,000 (Google Ads Spend) ÷ 40 (New Customers) = $50 CAC

Now we have a hard number. It costs $50 to acquire a customer through this specific campaign. We can do the same for Facebook Ads, Instagram promotions, and any other paid channel. And when thinking about where to find new customers, it's also worth exploring effective product promotion strategies on TikTok to see how that platform could fit into your marketing mix.

The Tricky Part: Calculating SEO CAC

Organic channels like SEO are a different beast entirely. The investment you make in SEO today might not pay off for three, six, or even twelve months. This makes the calculation a bit less direct, but it's just as important.

With SEO, your costs aren't ad clicks. They are things like:

- Agency Retainer: The monthly fee you pay to an SEO agency in Melbourne.

- Content Creation: Costs for blog posts, articles, and other on-page content.

- Technical SEO: Time or money spent by a WordPress developer in Melbourne on site speed optimisation, schema markup, and other technical fixes.

- Link Building: Any budget allocated to outreach or digital PR.

To calculate SEO CAC, you need to look at your organic customer growth over time.

Example: A 6-Month SEO Push

Imagine a business invests $2,000 per month into an SEO retainer. Over six months, their total investment is $12,000. Before they started, they were getting 50 new customers a month from organic search. Now, they're getting 150.

That's an increase of 100 new organic customers per month, which adds up to 600 new customers over that six-month period.

The calculation looks like this:

$12,000 (Total SEO Spend) ÷ 600 (New Organic Customers) = $20 CAC

Even though it takes longer to see the results, an SEO CAC of $20 is fantastic compared to the $50 CAC from our Google Ads example. This is exactly why SEO is such a powerful long-term strategy for sustainable growth. It's an investment that keeps paying dividends long after you've made it.

By breaking down your CAC by channel, you move from guessing to knowing. You can build a marketing engine where every dollar is put to its most effective use, fuelling growth without wasting a cent.

Feeling the sting of a high CAC? You're not alone. I've sat across the table from dozens of business owners, looking at their ad spend reports with a sense of dread, wondering why it costs so much just to bring in one new customer.

The truth is, a high Customer Acquisition Cost is usually a symptom of a deeper issue somewhere in your marketing funnel. Drawing from years of helping eCommerce businesses across Australia, I've seen the same culprits pop up time and time again. This isn't about pointing fingers; it's about running a diagnostic check to find and plug the leaks in your strategy.

Mismatched Audience Targeting

One of the most common reasons I see for an inflated CAC is simply showing your ads to the wrong people. You can have the best product and the most beautiful creative, but if your audience isn't right, you're just burning cash. This is especially true on platforms like Facebook Ads where you pay for impressions.

Showing your ads to an audience that's too broad or just not interested means your click-through rates will tank and your cost per conversion will skyrocket. It’s like trying to sell steak to a vegan convention—you might get a few curious looks, but you won't make many sales. A specialised Facebook ads agency can help you dial in your targeting to reach people who are actually ready to buy. Mastering Facebook Ads is a skill that directly impacts your bottom line.

Low-Converting Landing Pages

So, your ad worked, and you got the click. Fantastic. But where are you sending that traffic? If your landing page isn't optimised to turn that click into a sale, you're pouring expensive traffic into a leaky bucket.

A high CAC is often a direct result of simple landing page mistakes:

- Slow Page Speed: If your Shopify or WordPress site takes an eternity to load, people will bail before they even see your offer. This is where expert WordPress development or Shopify design makes a huge difference.

- Confusing Messaging: The message on your landing page has to match the promise you made in the ad. Any disconnect creates confusion and an immediate exit.

- No Clear Call-to-Action (CTA): What do you actually want the user to do? If it isn’t painfully obvious, they won't do it.

A clunky checkout process on your Shopify site or a simple lack of trust signals (like reviews or security badges) can also kill your conversion rate and send your CAC through the roof.

The Broader Market Reality

Sometimes, a rising CAC isn't entirely your fault. Broader market trends, especially here in our local market, can have a massive impact. From 2023 to 2025, Australian DTC eCommerce CAC surged by roughly 40%.

This mirrors global trends but is amplified in our smaller, highly competitive market, putting us 20-35% above US levels. This jump is driven by privacy changes, attribution challenges (making things like Meta Conversion API setup essential), and fierce ad competition, hitting businesses in places like Melbourne particularly hard. You can explore the full analysis on Australian CAC trends to see how these factors are reshaping the landscape.

By understanding the 'why' behind a high CAC, you can start taking targeted, effective action to fix it.

Proven Strategies to Lower Your CAC and Boost Profitability

Knowing your Customer Acquisition Cost is one thing, but actually lowering it is what fuels real business growth. This is where the theory stops and the practical work begins. As a marketing agency in Melbourne, my team and I spend our days deep in the trenches, implementing strategies to make every marketing dollar work harder.

Ultimately, it’s all about creating a more efficient path from that first click to a final conversion. Below, I’ll share the proven, actionable strategies we use to drive down CAC for our eCommerce clients, from dialling in their websites to getting more from the customers they already have.

Optimise Your Website for Conversions

Think of your website as the final hurdle. A potential customer has to clear it before they hand over their money. It doesn't matter how brilliant your ads are; a clunky, slow, or confusing website will absolutely kill your conversion rate and send your CAC skyrocketing. This is where Conversion Rate Optimisation (CRO) comes into play.

We always start by focusing on these key areas:

- Improve Site Speed: Every single second counts. A faster-loading site, whether it's a custom Shopify development or a complex WordPress design, keeps people engaged and dramatically reduces bounce rates.

- Simplify the Checkout Process: Get rid of unnecessary steps, fields, and distractions. A clean, streamlined checkout on your Shopify store can instantly increase the number of completed purchases.

- Enhance User Experience (UX): Make it dead simple for people to find what they're looking for. Clear navigation, a logical site structure, and a mobile-first design are completely non-negotiable.

Refine Your Ad Targeting and Creative

Wasted ad spend is one of the biggest culprits behind a high CAC. The secret to efficiency is showing the right message to the right person at the right time. This isn’t a set-and-forget task; it requires constant testing and refinement.

As a Facebook ads agency, we live and breathe this stuff. We run a rigorous creative testing process to pinpoint which images, videos, and ad copy truly resonate with your target audience. We also help clients properly set up the Meta Conversion API, which is crucial for getting reliable data to optimise campaigns in a post-iOS14 world.

The goal isn't just to get cheaper clicks; it's to get more valuable clicks from people who are genuinely likely to buy. That's the difference between just spending money and investing it wisely.

Increase Your Customer Lifetime Value (CLV)

Here’s a powerful mindset shift for you: instead of only focusing on lowering CAC, put some serious effort into increasing the value of each customer you acquire. When your Customer Lifetime Value (CLV) is higher, you can afford to spend more to bring in a new customer and still be highly profitable.

Email marketing is one of the best tools for this job. By nurturing the relationship you have with existing customers through targeted email campaigns, you can encourage repeat purchases and build genuine loyalty. This simple act turns a one-time buyer into a long-term asset, fundamentally changing the economics of your entire acquisition strategy.

Leverage Lower-Cost Acquisition Channels

While paid ads on Google and Meta can deliver results fast, they can also get expensive. A truly sustainable growth strategy needs to include lower-cost channels that build momentum over time.

This is exactly where investing in a skilled SEO agency in Melbourne pays dividends. SEO is definitely a long-term play, but once you start ranking, it drives highly qualified traffic for a fraction of the cost of paid ads. The customers you get through organic search often have a much higher intent and, over the long run, a lower CAC. For businesses that can't afford an agency, even improving your Google My Business profile can make a significant impact.

To put these ideas into action, explore these practical 10 actionable advertising ideas for small businesses.

By combining these strategies—improving your website, refining your ads, increasing customer value, and diversifying your channels—you can systematically lower your what is customer acquisition cost and build a more profitable, resilient eCommerce business. It’s a continuous process of testing, learning, and optimising.

Alright, let's tackle a few of the common questions I get from clients after we've run through the basics. Getting your head around the main formula is one thing, but the real-world questions pop up once you start digging into your own numbers.

How Often Should I Calculate My CAC?

I always tell my clients to calculate their blended CAC at least once a month. This gives you a regular, meaningful snapshot of how you're tracking without getting lost in the noise of daily ups and downs.

Of course, for specific campaigns—like a flash sale you've pushed hard with Google Ads—you'll want to calculate the CAC for that isolated period. It's the only way to truly know if that short, sharp effort paid off.

What Is a Good CAC to LTV Ratio?

While every business is unique, the gold standard for a healthy Customer Lifetime Value (LTV) to CAC ratio is 3:1. In simple terms, this means for every dollar you spend bringing a new customer in, you get three dollars back over their entire relationship with your brand.

If your ratio is sitting at 1:1, you’re essentially breaking even on the marketing spend, which means you're losing money once you factor in the cost of your products or services. On the flip side, if you see it creeping up to 5:1 or higher, it might actually be a sign you’re not investing enough in marketing and could be growing a lot faster.

Can My CAC Be Zero?

Technically, no. This is a big one. Even customers who come through "free" channels like word-of-mouth or an organic search result still have a cost attached.

Think about it: for SEO, you've paid for the content to be written or you have an SEO agency Melbourne on retainer. For word-of-mouth, you had to spend money to acquire the original customer who is now referring their friends. Every single customer has an acquisition cost, even if it's not a direct ad click. Grasping this helps you place the proper value on every single marketing channel.

Alpha Omega Digital is a marketing agency based in Melbourne, Australia but also services clients from Sydney, Brisbane, Newcastle, Perth, Adelaide, Darwin and Hobart. Have a project in mind? Contact us.